Option to Utilize the amount in cash ledger of one GSTIN by Another GSTIN having same Pan

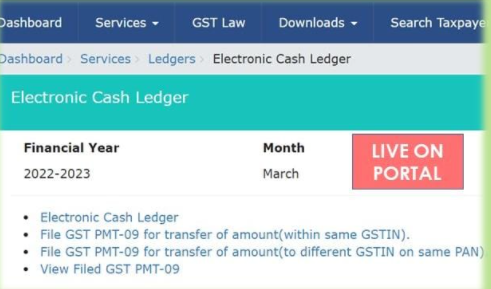

Rule-87(14): Electronic Cash Ledger

a registered person may, on the common portal, transfer any amount of tax, interest, penalty, fee or any other amount available in the electronic cash ledger under the Act to the electronic cash ledger for central tax or integrated tax of a distinct person as specified in sub-section (4) or, as the case may be sub-section (5) of section 25, in form GST PMT-09: Provided that no such transfer shall be allowed if the said registered person has any unpaid liability in his electronic liability register